Specialist School Fee Recovery Services for UK Independent Schools

Cavendish Sinels is pleased to offer UK independent schools a ‘No Win – No Fee’ solution to the challenge of recovering unpaid fees while preserving reputations and relationships.

Client loginCavendish Sinels

Enhancing the relationship between schools and parents

Cavendish Sinels is pleased to offer UK independent schools a ‘No Win - No Fee’ solution to the challenge of recovering unpaid fees while preserving reputations and relationships between schools and parents.

The financial climate has rarely been more challenging for the independent education sector. Market pressures, the effect of VAT and dramatic long-term effect of coronavirus coupled with rising teachers' pension costs, an uncertain global political landscape and the ongoing need for capital investment, have put a strain on annual budgets – one that cannot always be alleviated through cost-cutting measures alone.

Our No Win - No Fee approach to debt recovery, honed over almost a century of experience in this field, can help to unlock additional funds that rightfully belong to a school, boosting the bottom line and promoting financial sustainability.

We act as an extension of the Bursar’s office, supporting your in-house finance team by recouping historic, complex or relationally-sensitive debt on your behalf, acting both within the UK and internationally as required. From debt that has previously been written off, to more recent non-payment or late payment, our status as an independent third party is often helpful in securing a successful resolution to this complex problem.

Our processes are transparent, robust and secure. We understand and respect the importance of school-parent relationships and, with 60% of client schools engaging us repeatedly, we can be relied upon to deliver the results and standards that you demand.

Meet the team

Peter Kent

Chief Executive Officer

A former Stockbroker and Global Fund Manager with extensive experience in developing Financial Services and Education Sector businesses....

Read more

Robert Durrant

Chief Operating Officer

Robert has many years of senior management experience in sectors including Independent Education, Marine, Engineering and Corporate...

Read moreChris Lucas-Jones

Process Service and High Court Enforcement Officer

Chris is an Authorised High Court Enforcement Officer (AHCEO) enabling enforcement of High Court Writs. He holds a County Court Enforcement...

Read moreJacqui Hammond

Senior Negotiator (Spain)

Jacqui is a qualified accountant with many years experience working in the public sector for both the NHS and the Police. Jacqui then moved...

Read moreJonathan Cubitt ACA

Senior Negotiator

Johnny is a qualified accountant, formerly of BDO Binder Hamlyn, and Peat Marwick McClintock and Financial Controller of the Royal Opera...

Read moreBob Snelling

Head of UK and Global Trace and investigations

Robert is the former senior manager at Europe’s largest debt purchaser, responsible for the recruiting, training and development of a...

Read moreOur approach

Our methodology

Once instructed, Cavendish Sinels will commence correspondence and negotiations with the parent(s), in a manner designed to avoid causing offence, and offer them an early opportunity to raise any valid complaint pertaining to the claim or settlement proposals.

Should it be necessary, we will despatch further correspondence to advise the parent(s) that they risk jeopardising their credit rating and to raise the prospect of legal action by our in-house legal department.

If appropriate, Letters Before Action will be issued between days 15 and 22, dealing with the potential impact of litigation should settlement or repayment proposals fail to be received within 48 hours.

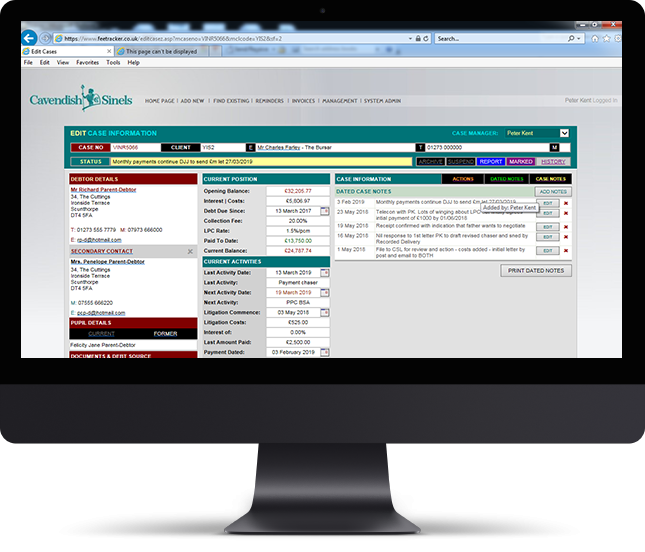

Our systems

Cavendish Sinels has a robust, secure operating platform that complies with all GDPR and anti-money laundering legislation. We apply stringent Financial Probity Checks and ensure that all international money transfers meet FOREX criteria.

You retain control

Client School Bursars, Finance Officers and Govorners are invited to log on to our system where they can view or print their own debtor files at will, making it easy to present a single report to governors’ F&GP and SLT meetings.

The school’s aged debtors reports, payment histories and individual debtor reports can all be accessed via a unique log-in code and encrypted password.

Online Instruction Service

On the basis that the phrase “CASH is KING” has never been more important than it is today and In response to requests from a considerable number of Bursars, CavendishSinels has now launched three new services online. These deal with the recovery of :

SMALL DEBTS

Of between £100 and £2,000 which can be submitted without the need for a copy Parent Contract or Statement/Invoice…..The Instruction fee has been reduced to £50.00 and the recovery charges pegged at 14% no matter where in the world or how old the debt (up to 6 years) most schools are using this to mop up old extras and balances that have been left following departure of the pupil and/or where there simply isn't the time to chase them.

STANDARD DEBTS

A new simplified process that can be submitted without a Debt Recovery Sanction Form.

Once a school has completed the on-screen form with the parent/pupil/debt instruction details you can attach any supporting documents to an email.

All client schools now have an internally generated CSL email account, accessed by clicking the hyperlink at the bottom of the form which you will only see when you are ready to submit a STANDARD debt for recovery.

CURRENT TERM’S FEES [No upper Limit]

- This is designed to speed up your cashflow where invoices issued for next term and will be pegged at an instruction cost of £30.00 and 5% of the sum claimed. This will apply no matter where the parent resides [UK/EU/NonEU].

- That Instruction fee of £30 [+ VAT] PLUS the Recovery Fees of 5%[+VAT] will be recovered from the parent at the same time as and in addition to your Invoice balance.

- All letters have been re-drafted to take account of the current Covid19 circumstances but also, to ensure that parents understand that you have already made significant reductions in charges to reflect that.

- Similarly, parents need to understand that failure to settle their accounts can only mitigate against those who do pay or possibly lead to the withdrawal of pupils whose parents do not settle.

- That said, the CURRENT term’s recovery cycle will also include a letter thanking each parent for their payment once all monies have been received.

- All funds received from parents will be credited to their account in our systems using YOUR PUPIL REFERENCE and then transferred to you as a batch payment daily [as we always do]

Our services

UK Education Sector Debt Management

With more than 90 years of legal and education sector experience, Cavendish Sinels is pleased to offer UK independent schools a ‘No Win - No Fee’ solution to the challenge of recovering unpaid fees while preserving reputations and relationships.

| CHARGES | WHERE A DEBT HAS REMAINED OUTSTANDING FOR |

| UP TO 1 YEARS | 1 - 2 YEARS | 2 - 3 YEARS | OVER 3 YEARS | |

| Where a debtor resides in the UK | 11.0% | 16.5% | 22% | + 5.5%* |

* FOR EACH ADDITIONAL YEAR

Old and written-off school debt

The cost of tackling old debt is often prohibitive, as schools weigh up the costs involved in instructing solicitors, together with Court Fees, without any guarantee of success. At Cavendish Sinels, we are able to bring written-off debt back on to a school’s balance sheet while covering all litigation costs ourselves.

To facilitate the recovery of old debt, there must have been some movement on the account within the last six years, such as a payment made or an admission of liability given or an additional invoice issued.

Accrued current pupil debt

We understand that debt can build up when a school is committed to maintaining the stability of a child’s education in the face of challenging family issues, such as separation and divorce, redundancy or bankruptcy. In situations where a repayment arrangement has failed, yet the school wishes to safeguard their ongoing relationship with the parent(s), the involvement of an independent third party can offer a diplomatic and sensitive solution to debt recovery.

Former pupil debt

Where pupils have been excluded for non-payment of fees, or they have failed to return to school leaving outstanding debts, Cavendish Sinels can pursue not only the unsettled invoices but also, where applicable, the school’s entitlement to Fees in Lieu of Notice and costs.

Our services

International Debt Management for the Education Sector

With a shift in global pupil source markets, particularly since the coronavirus pandemic, it is imperative that schools can access robust procedures for managing non-UK debt.

Cavendish Sinels offers full cross-border recovery expertise and access to an international network of experienced lawyers and investigators. We are not daunted by geographical location, nor by professional debtors.

With a shift in global pupil source markets, particularly since the coronavirus pandemic, it is imperative that schools can access robust procedures for managing non-UK debt.

Cavendish Sinels offers full cross-border recovery expertise and access to an international network of experienced lawyers and investigators. We are not daunted by geographical location, nor by professional debtors.

| OUR CHARGES | WHERE A DEBT HAS REMAINED OUTSTANDING FOR |

Up to 1 YEARS | 1 - 2 YEARS | 2 - 3 YEARS | Over 3 YEARS | |

| When a debtor resides in the E.U. | 18.7% | 26.4% | 32.1% | + 7.7%* |

| When a debtor resides outside the E.U. | 22.0% | 33.0% | 44.0% | + 11.0 %* |

* For each additional year

“We are most grateful for the way that you have treated us during this most unfortunate period of financial stress. You seem to balance the requirements of your job with some common sense and decency.”

Our services

International Debt Management for the Education Sector

With a shift in global pupil source markets, particularly since the coronavirus pandemic, it is imperative that schools can access robust procedures for managing non-UK debt.

Cavendish Sinels offers full cross-border recovery expertise and access to an international network of experienced lawyers and investigators. We are not daunted by geographical location, nor by professional debtors.

“We are most grateful for the way that you have treated us during this most unfortunate period of financial stress. You seem to balance the requirements of your job with some common sense and decency.”

Subject only to a non-returnable instruction fee of £200 (E.U.) or £300 (non-E.U.), our charges would follow the scale below, payable only upon successful debt recovery.

Our charges (When a debtor resides in the EU)

Up to one year: 18.7%

One to two years: 26.4%

Two to three years: 34.1%

Over three years: + 7.7%*

Our charges (When a debtor resides outside the EU)

Up to one year: 22.0%

One to two years: 33.0%

Two to three years: 44.0%

Over three years: + 11.0%*

*For each additional year

Our services

Litigation for the Education Sector

Unlike school solicitors, we make no negative demands on a school's cash flow during this process and are wholly motivated to improve the school's bottom line.

With a very easy system to use, a low initial outlay to the school and being kept abreast of progress at each stage, I wish we had been using Cavendish Sinels all along as it would have saved the School a lot of time and money in the past.

I cannot recommend their services highly enough.

Bursar - Homefield School.

To our knowledge, we are the only specialist debt recovery firm to offer the independent school sector an in-house national/international tracing and litigation service, and therefore a complete debt management solution that covers all eventualities.

What our clients and parents say about us

Make an enquiry today

Do you have any questions or want to start a claim..?

Feel free to call us

0207 610 6800Or you can email us

info@cavendishsinels.com